European Online Gambling Market

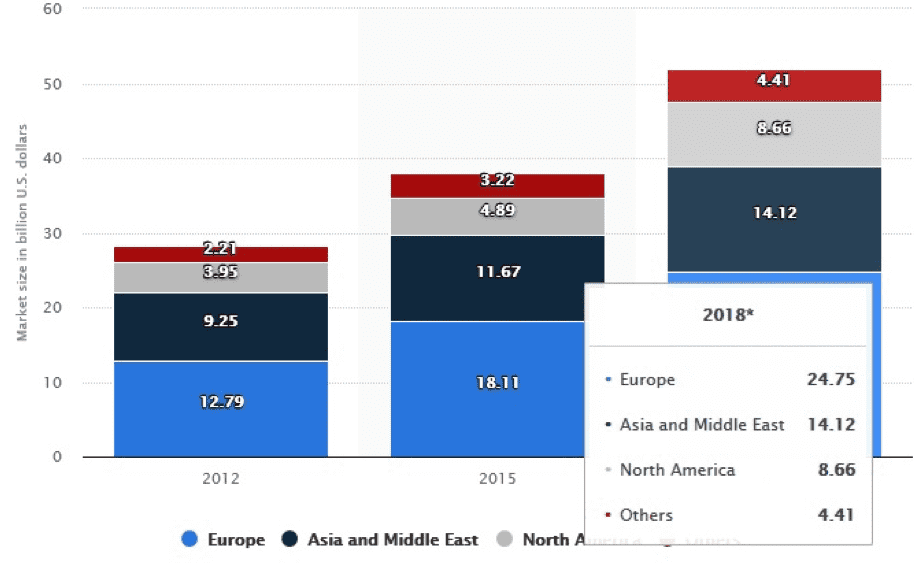

Europe Online Gambling Market 2020-2025: Growing Hardware and Software Innovations to Drive Market Growth The 'Europe Online Gambling Market - Growth, Trends, and Forecast (2020-2025)' report has. The global online gambling market size was valued at USD 53.7 billion in 2019 and is expected to grow at a compound annual growth rate (CAGR) of 11.5% from 2020 to 2027. The high internet penetration and increasing use of mobile phones among individuals for playing online games from their homes and public places are driving the market.

Online Gambling Market Size

Dublin, Nov. 10, 2020 (GLOBE NEWSWIRE) -- The 'Europe Online Gambling Market - Growth, Trends, and Forecast (2020-2025)' report has been added to ResearchAndMarkets.com's offering.

The European online gambling market is projected to grow, witnessing a CAGR of 9.20% during the forecast period (2020-2025).

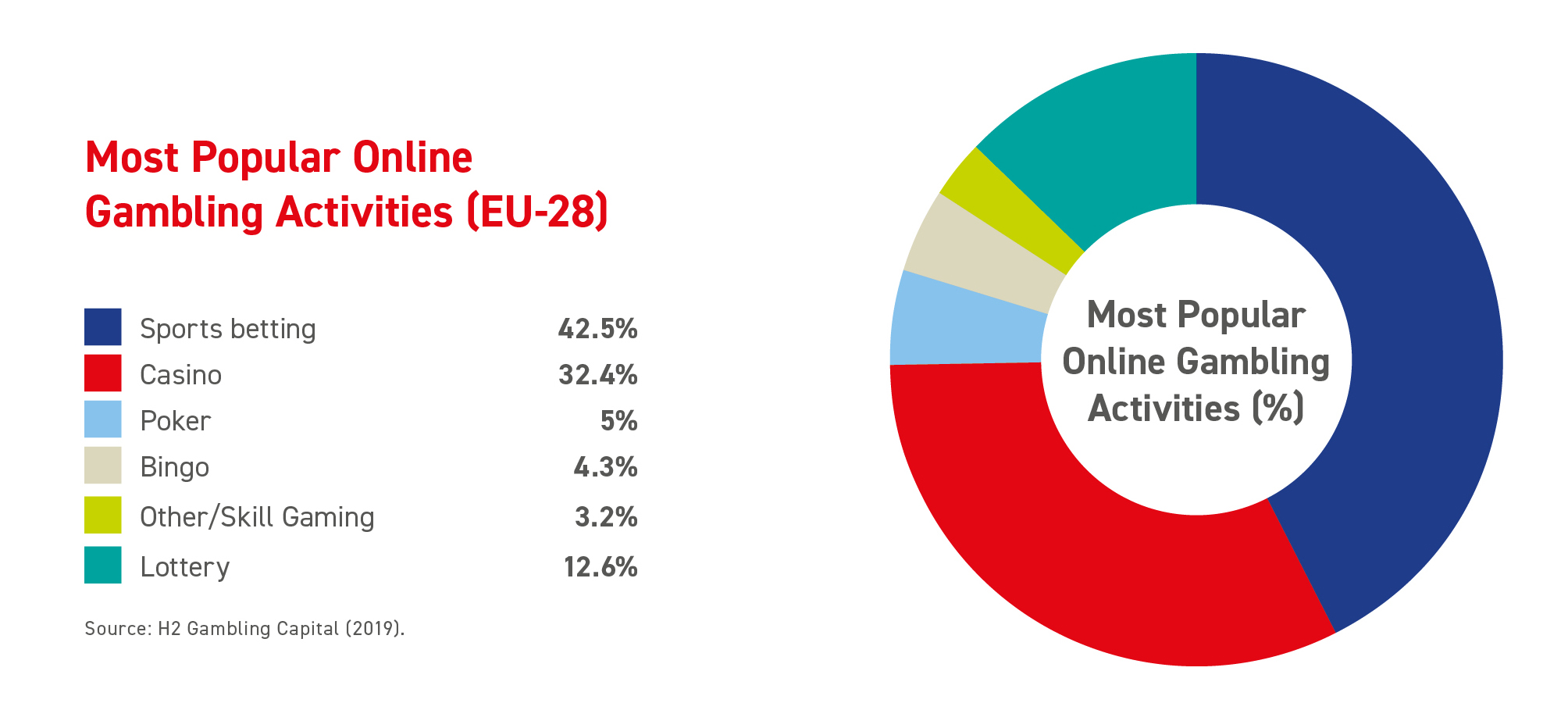

Growing hardware and software innovations and the rising popularity of casino and sports betting gambling, along with enhanced internet penetration, are expected to drive the growth of the European online gambling market.

The dominating players have been focusing on mergers over the past few years, primarily to increase their stake in the market and to improve profit margins. For instance, Paddy Power PLC and Bet fair PLC merged to form Paddy Power Betfair PLC.

In order to gain a competitive advantage and compete with the established players, companies are developing innovative offerings in the region. For instance, in April 2019, one of the UK's leading casino companies, 888 Holdings, had signed up a new gaming partnership with software maker, Microgaming.

Key Market Trends

Desktop Devices Holding The Major Share

Online gaming started on desktop computers, and many online casinos still focus most of their development on making sure that players get a smooth and well-presented user-interface experience. Desktops and laptops are considered to be the most convenient devices for online gambling owing to their bigger screen size. This factor provides the gamer with the ultimate online gaming experience.

One of the major benefits of using the desktop as an option to play online casino is that the number of mobile casino games on offer is significantly fewer than desktop gaming. Moreover, some of the mobile casino games only offer a few selections of the deposit options as compared to a desktop site. However, rising penetration of smartphones, owing to its convenience, is affecting the growth and demand for the gambling market operated through desktops/laptops.

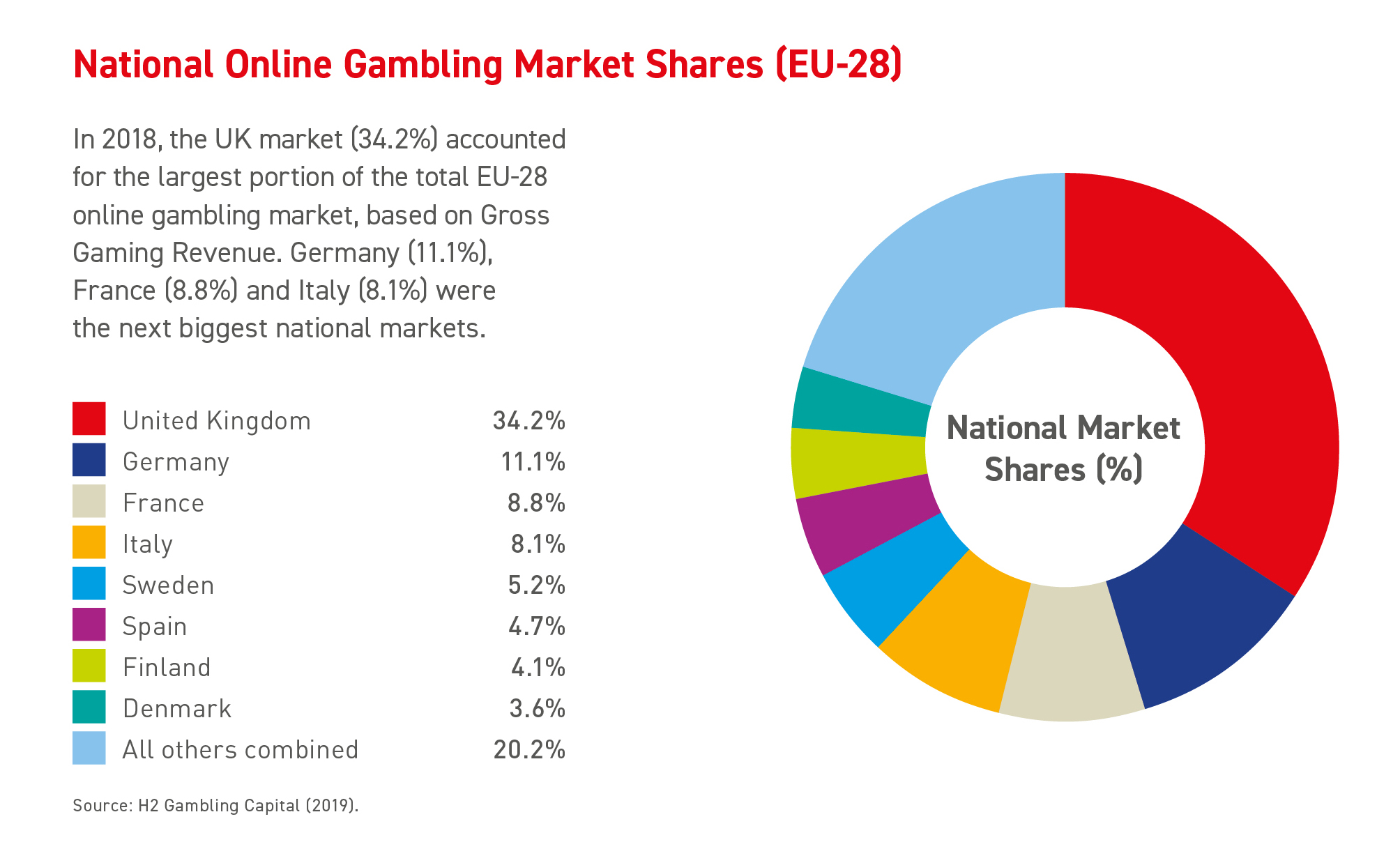

United Kingdom Leading The Market

Sports betting in the United Kingdom is provided by the private sector and is conducted within a very competitive market. Online gambling is legal and regulated in the country by the Gambling Commission, which was formed by the Gambling Act of 2005. Online poker, sports betting, casino games, bingo, and lottery-style games all fall under the purview of the Gambling Commission.

As per the data published by OfCom (The Office of Communications, United Kingdom) in 2015, 6% of the users aged between 25-34 and 45-54 years engaged themselves in online gambling at least once in every three months. The second highest age group was between 16 and 24 years, which accounted for 4%. Rizk Casino, 888 Holdings, Casumo Casino, bet365, and LeoVegas are some of the prominent players operating in the UK online gambling market.

Competitive Landscape

Bet365, 888 Holdings Plc, GVC Holdings PLC, Kindred Group PLC, William Hill PLC, and Betsson AB are some of the major players having a significant presence across Europe. nMany online gambling companies rely on third-party providers, such as Playtech, for software solutions. However, some companies choose to backward integrate with technology providers.

For instance, 888 poker heavily invested in developing its own software and online gaming technology, primarily not to rely on suppliers. Similarly, William Hill, a bookmaker company located in the United Kingdom, was focused on backward integration, and thus, acquired Grand Parade, a software development company, in 2016.

Key Topics Covered:

1 INTRODUCTION

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

4.1 Market Drivers

4.2 Market Restraints

4.3 Porter's Five Force Analysis

5 MARKET SEGMENTATION

5.1 By Game Type

5.1.1 Sports Betting

5.1.1.1 Football

5.1.1.2 Horse Racing

5.1.1.3 E-Sports

5.1.1.4 Other Sports

5.1.2 Casino

5.1.2.1 Live Casino

5.1.2.2 Baccarat

5.1.2.3 Blackjack

5.1.2.4 Poker

5.1.2.5 Slots

5.1.2.6 Other Casino Games

5.1.3 Lottery

5.1.4 Bingo

5.2 By End-use

5.2.1 Desktop

5.2.2 Mobile

5.3 By Geography

6 COMPETITIVE LANDSCAPE

6.1 Most Active Companies

6.2 Most Adopted Strategies

6.3 Market Share Analysis

6.4 Company Profiles

6.4.1 Betsson AB

6.4.2 888 Holdings PLC

6.4.3 The Stars Group Inc.

6.4.4 The Kindered Group

6.4.5 GVC Holdings

6.4.6 William Hill PLC

6.4.7 Bet365 Group Ltd

6.4.8 LeoVegas AB

6.4.9 Flutter Entertainment

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

For more information about this report visit https://www.researchandmarkets.com/r/ja0pkm

Research and Markets also offers Custom Research services providing focused, comprehensive and tailored research.

Dublin, Dec. 09, 2019 (GLOBE NEWSWIRE) -- The 'Europe Online Gambling Market 2019' report has been added to ResearchAndMarkets.com's offering.

Europe's Online Gambling Market Holds Strong

The report 'Europe Online Gambling Market 2019' highlights the strength of the European online gambling market.

Taking the largest share of the global online gambling market, Europe will continue its growth as a global market contributor. Legislation and legalization have played a role in this process, opening up more legal marketplaces for online gambling. Online gambling penetration in the EU is expected to grow through 2020, as quoted in the report.

Online gambling consistently makes up a larger share of the global gambling market year after year. Since 2016, global online gambling revenues have experienced double digit growth and this trend is set to persist through 2023, according to a statistic cited in the report. The European market adds a great deal of value to the overall global market and exhibits regular revenue growth as well.

The United Kingdom is the largest and the most active market for online gambling in Europe. The British online gambling platform bet365 is also a market a leader in Germany, Italy, Spain, and Denmark, ousting local marketplaces in some countries. In terms of expansion, Italy and France's online gambling markets have been growing rapidly, in regards to numbers cited in the report.

Europe's role in the online gambling market

The global online gambling market's biggest player, Europe, will maintain its growth in the global marketplace. Through 2020, online gambling penetration is expected to rise across the EU.

Online gambling revenue exhibits persistent, high growth rates

Year after year, online gambling takes a larger portion of the overall global gambling market. Through 2023, double-digit revenue growth in the online gambling market will persist around the globe.

Europe's largest online gambling market contributors

The most engaged online gambling markets in Europe include the UK, Spain, Italy and others. Britain's bet365 platform is consistently a market leader among online gambling among these countries.

Questions Answered in this Report

- What is the forecast for the global online gambling and betting market revenues by 2023?

- How high is Europe's share of the global online gambling market?

- Who are the major players in the global online gambling market in Europe?

- Which are the leading sectors of online gambling across Europe?

- What are the main market trends affecting the development of online gambling in Europe?

Key Topics Covered:

1. Management Summary

2. Global Developments

Online Gambling Wagers, in USD billion, 2017, 2018e and 2022f

Online Gross Gambling Revenues, in EUR billion, and Penetration, in % of Total Gross Gambling Market Revenues, 2013 - 2023f

Breakdown of Online Gross Gambling Revenues, by Region, in %, 2017

3. Europe

3.1 Regional

Online Gambling Market Trends, January 2019

Online Gross Gambling Revenues, in EUR billion, 2017 - 2020f

Online Share of Total Gambling Revenues, in %, 2017 & 2020f

Breakdown of Online Gross Online Gambling Revenues by Activity, in %, 2017

3.2 UK

Remote Gambling Turnover and Gross Gambling Yield, in GBP million, by Segment and Total, April 2015 - March 2016, April 2016 - March 2017, April 2017 - March 2018

Share of the Remote Sector, in % of Total Gross Gambling Yield, April 2017-March 2018

Breakdown of Online Gambling Market Shares, by Selected Top Players, in % of Revenues, 2017

Top 5 Gambling Websites, incl. Total Website Visits, in millions, UK's Share of Total Visits, in %, Average Time Spent per Visit, and Bounce Rate, in %, December 2018

3.3 Germany

Gross Gambling Revenues by Segment, by Regulated and Non-Regulated Market, incl. Online, in EUR million, 2017

Top 5 Gambling Websites, incl. Total Website Visits, in millions, Germany's Share of Total Visits, in %, Average Time Spent per Visit, and Bounce Rate, in %, December 2018

3.4 France

Online Gross Gambling Revenues, in EUR million, 2015 - 2017

Share of Online Gambling, in % of Total Gross Gambling Revenues, 2017

List of Licensed Gambling Operators, incl. Website, January 2019

Top 5 Gambling Websites, incl. Total Website Visits, in millions, France's Share of Total Visits, in %, Average Time Spent per Visit, and Bounce Rate, in %, December 2018

3.5 Italy

Online Gambling Expenditure by Segment and Total, in EUR million, 2011 - 2017

Share of Online Gambling, in % of Total Gambling Expenditure, 2017

Mobile Gambling Expenditure, in EUR million, 2016 & 2017

Average Number of Monthly Active Online Gambling and Betting Users, in thousands, 2016 & 2017

Top 30 Operators in Online Casino by Market Share, in %, 2018

Top 30 Operators in Online Sports Betting by Market Share, in %, 2018

Top 5 Gambling Websites, incl. Total Website Visits, in millions, Italy's Share of Total Visits, in %, Average Time Spent per Visit, and Bounce Rate, in %, December 2018

3.6. Spain

Total Amount Played in Online Gambling and Betting, by Segment, in EUR million, 2016 - 2017, Q1-Q3 2018

Gross Gambling Revenues from Online Gambling and Betting, by Segment, in EUR million, 2016 - 2017, Q1-Q3 2018

Online Gambling Deposits, Withdrawals and Gross Gaming Revenue, in EUR million, 2013 - 2017, Q1-Q3 2018

List of Licensed Gambling Operators with Websites, January 2019

Top 5 Gambling Websites, incl. Total Website Visits, in millions, Spain's Share of Total Visits, in %, Average Time Spent per Visit, and Bounce Rate, in %, December 2018

3.7 Denmark

Online Casino Deposits, Winnings, Operator Commission and Gross Gaming Revenue, in DKK million, 2013 - 2017, Q1-Q3 2018

Breakdown of Gross Gambling Revenues from Online Casino Games by Mobile and Desktop/ Laptop, in %, September 2017- October 2018

Top 5 Gambling Websites, incl. Total Website Visits, in millions, Denmark's Share of Total Visits, in %, Average Time Spent per Visit, and Bounce Rate, in %, December 2018

3.8 Russia

Share of Online Betting Deposits, in % of Total Betting Deposits, 2018e

Breakdown of Preferred Betting Channels, in % of Men Who Make Sports Bets, 2018

Top 5 Gambling Websites, incl. Total Website Visits, in millions, Russia's Share of Total Visits, in %, Average Time Spent per Visit, and Bounce Rate, in %, December 2018

3.9 Norway

Number of Online Gambling Players, in thousands, 2016 & 2017

Breakdown of Devices Used for Online Gambling, in % of Players, 2017

Breakdown of Channels of Used for Online Gambling, by Local and Foreign, in % of Players, 2017

Top 5 Gambling Websites, incl. Total Website Visits, in millions, Norway's Share of Total Visits, in %, Average Time Spent per Visit, and Bounce Rate, in %, December 2018

3.10 Sweden

Services Purchased Online, in % of Internet Users, Q2 2018

Top 5 Gambling Websites, incl. Total Website Visits, in millions, Sweden's Share of Total Visits, in %, Average Time Spent per Visit, and Bounce Rate, in %, December 2018

3.11 Finland

Top 5 Gambling Websites, incl. Total Website Visits, in millions, Finland's Share of Total Visits, in %, Average Time Spent per Visit, and Bounce Rate, in %, December 2018

Online Share of Total Gambling Revenues of Veikkaus, in %, Q3 2018

Companies Mentioned

- 888 Holdings Ltd

- AB Svenska Spel

- Bet365 Group Ltd

- Danske

- Det Danske Klasselotteri A/S

- La Francaise Des Jeux S.A

- Lottomatica S.p.A.

- Norsk Tipping AS

- Pari Mutuel Urbain GIE

- Premier Lotteries Investments UK Limited

- Sisal S.p.A.

- Sociedad Estatal Loteras y Apuestas del Estado

- Spil A/S

- The Stars Group Inc.

- Tipico Co. Ltd.

- Veikkaus Oy

- fonbet.ru

- myscore.ru

- stoloto.ru

European Online Gambling Marketing

For more information about this report visit https://www.researchandmarkets.com/r/7wcf11

Research and Markets also offers Custom Research services providing focused, comprehensive and tailored research.